The first betting exchange appeared in 2000 as a way for punters to bet against each other rather than against a bookie. Betting exchange users have the option of setting their own odds or accepting odds that have already been offered – the odds are pooled so it’s actually ‘peers-to-peers’ rather than ‘peer-to-peer’. The odds move in reaction to news and events, as well as the prices offered by bookies.

The first betting exchange appeared in 2000 as a way for punters to bet against each other rather than against a bookie. Betting exchange users have the option of setting their own odds or accepting odds that have already been offered – the odds are pooled so it’s actually ‘peers-to-peers’ rather than ‘peer-to-peer’. The odds move in reaction to news and events, as well as the prices offered by bookies.

Betting exchanges make their money by charging a commission on winning bets. Even taking this into account, however, betting exchanges generally offer better odds than traditional bookmakers or betting sites.

Best Betting Exchanges for UK Punters

| Site | Commission | Discount Rate | Visit |

|---|---|---|---|

| 2% | Now only 2% for all customers, based on the net win of a market (no charge if net loss). | ||

| 5% | Discount based on volume up to maximum of 60% (minimum commission rate is 2%). |

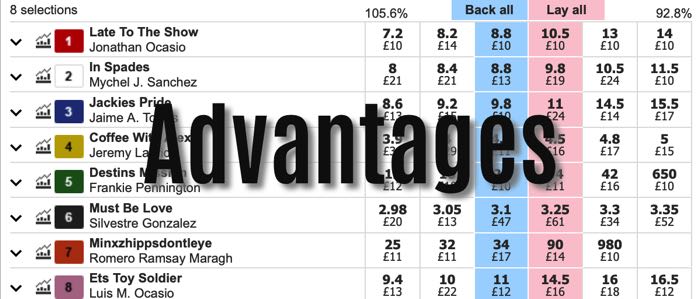

Advantages of Betting Exchanges

We’ve already discussed one of the main benefit that betting exchanges offer – better odds. Because the odds are set by the punters rather than the bookie, you’ll find that the equivalent vig is much lower. Exchanges change a commission – between 3 and 5% – on winning bets, but in a large number of cases the net cash winnings will still be greater than what you would have received from a bookmaker.

Lay Bets

The second significant advantage that a betting exchange offers is the ability to lay bets. Unlike traditional bookmakers where you can generally only bet for something to happen (eg: Arsenal to beat Liverpool, England will win the world cup or that it will snow on Christmas), by their very nature, betting exchanges allow you to bet against something (eg: Arsenal will not beat Liverpool, England will not win the world cup or it will not snow on christmas). This is an important factor as without someone to bet against, there would be no bet.

Betting against an outcome is known as ‘laying’ and is incredibly popular. For example, you might not have a good idea about who will win Wimbledon this year, but you may have a pretty good idea about who wont. The odds for these kinds of bets are usually very short – in fact, if an event is unlikely to happen (England winning the World Cup) you may need to wager £100 in order to win £10.

Hedge Your Bets

The second benefit of being able to lay bets is that it offers you the opportunity to quite literally ‘hedge your bets’. Lets say you place a bet of £100 on England to win the world cup during the group stages of the tournament at 15 to 1 (Ed: repeatedly using this as an example isn’t going to make it happen!). If England make it to the final, their odds will shorten significantly – let’s say 2/1.

In this scenario, you could ‘lay’ your England bet rather than let it ride. Your £100 bet stands to win £1,500, but if you were to place a £1000 bet in the opposite direction at 2/1 you have effectively neutralised your original bet (if they win you receive £1500 from the bookie and lose £1000 on the exchange leaving a £500 net win, and if they lose you would lose £100 at the bookie but gain £500 on the exchange).

Note: Hedging your bet no longer requires the use of an exchange as many bookies now offer a specific cash out feature for this very function.

Similarly, if you have a large accumulator that has made it to the final event, you may want to hedge all or part of the bet – especially if it’s for a significantly large payday.

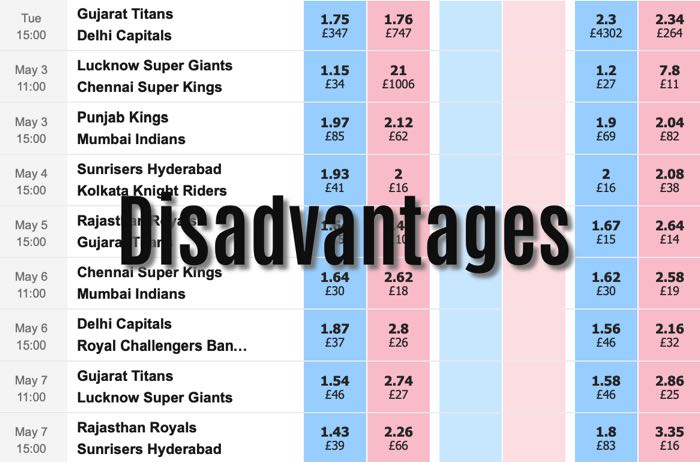

Disadvantages of Betting Exchanges

If betting exchanges are so great, why doesn’t everyone use them? In reality, a large majority of the betting public still use traditional bookmakers rather than betting exchanges.

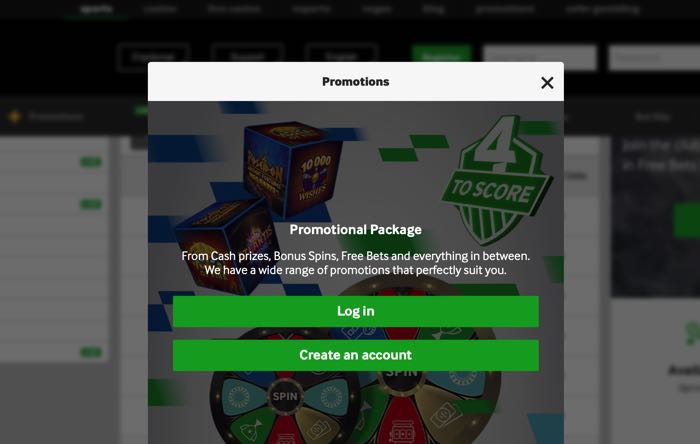

Not as Many Specials or Promotions

The reasons for this are twofold. First, because of the way an exchange is set up, and the fact that bets are not placed against the bookie, a betting exchange cannot offers as many specials and promotions as a bookmaker. For many punters, the draw of these promotions is far too tempting – even though they might still be better off betting at an exchange.

It’s not just introductory offers either, many bookmakers will offer their customers ongoing promotions and daily specials such as ‘money back if there’s a red card in a game’ or a ‘free bet if you horse wins at odds of 4/1 or greater’ – both of these are examples of real offers that we’ve seen from the fixed odds sportsbooks.

The principles of how a betting exchange works simply does not allow for this kind of promotions – Betfair cannot offer refunds on £25 bets when the exchanges commission on the bet would only be a couple of pounds. Remember – the money from a lost bet doesn’t go to the exchange, it goes to another punter. So, it just isn’t in the numbers.

No Multiples or Accas

The second major disadvantage of betting exchanges is a big one, and one that is unlikely to have a solution. Because each bet is against other customers, betting exchanges cannot offer multiple or accumulator bets – there is physically no way for the system to be able to handle it. Given the popularity of accumulators – particularly with the recreational ‘saturday morning’ crowd, this is a fairly heavy blow.

The exchanges have tried to overcome this by offering multiples in a traditional bookmaker format along side their peer-to-peer platform – where you are now betting against the house rather than another punter, but this defeats the whole point of the exchange and has had relatively poor uptake from the betting community who would rather stick to a bookie for this kind of bet.

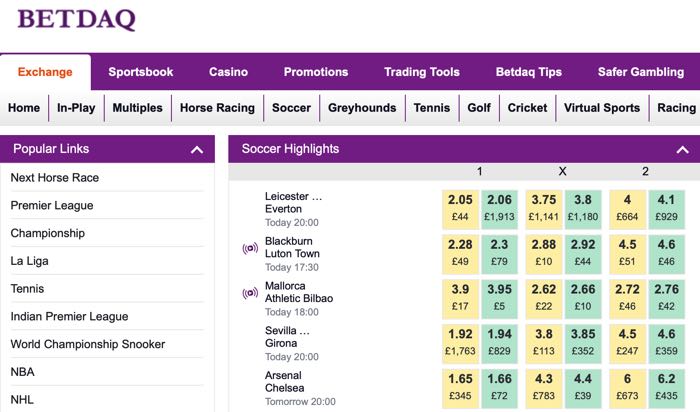

Betting Exchanges Vs Traditional Betting Sites/Bookmakers

Now you know benefits and disadvantages that a betting exchange offers over a traditional bookmaker, here comes the big question – which is better. From our perspective, it depends on what you’re looking for.

If you want to place straight bets without any fancy promotions, then betting exchanges will offer you a greater return for your money and are almost certainly your best bet. Similarly, if you want to be able to bet against an outcome, then betting exchanges are your solution. On the other hand, if you like free bets, money back specials and other promotions and/or you want to place multiple or accumulator bets, then a traditional format betting site is what you need.

How to Compare Betting Exchanges

When it comes to “normal” bookies there are tens, even hundreds to choose from. We have a separate article about how and why betting sites differ and what to look out for but how do you compare betting exchanges?

First of all, we should note that your options are far more limited when it comes to exchanges, as there are only a handful to choose from, rather than the massive range of conventional bookies that is available. In one sense, this makes it much easier because you only have to consider a few different betting exchanges. However, it also means that there are only smaller differences between the various options. But, what should you be looking for?

Trustworthiness

We hesitate to mention this, and list it first, for reasons we’ll explain. However, the most important factor when deciding to join any betting site (and quite possibly any website at all) is whether or not you can trust them. If a betting exchange won’t protect your personal and financial data, treat you fairly, or pay your winnings, what is the point in getting involved?

That said, the exchange model leaves itself less open to risk on the part of the operator. A badly run site can still get into financial troubles but in general, because they are simply a middleman, the risk of them getting things badly wrong is much smaller. In addition, at least at present, all the exchanges out there have been around for a decent length of time and are run by sizeable companies that we would certainly class as worthy of our trust. That said, should a new exchange launch, assessing how reputable and reliable it is should be the first thing you do.

Liquidity

The most important factor that can differentiate one exchange from another is the level of liquidity. In simple terms, this means the money that is going through the site and is available in the various markets. Unless there are people willing to lay the bets you want to make, you cannot place your wagers, certainly not at decent odds. Likewise, if there are no parties prepared to lay the selections you want to back, you are stumped.

Liquidity is not a problem at a traditional bookmaker and whilst some sites may have limits that are applied to stakes or winnings, all but the highest of high rollers should be able to make whatever bets they want without any problems. Even the biggest and best betting exchanges, however, may struggle for liquidity on smaller sports and markets. In addition, you may find that the liquidity only arrives relatively close to the start of an event, so if you are a punter who likes to seek value by placing your wagers early, this is worth noting.

If you are tempted to opt for one of the smaller, less well-established betting exchanges, we strongly suggest you check out how much money is available there before you do so. You should look at a selection of markets, including smaller ones and you should also look at the liquidity just before a match or race starts, as well as a few days or even weeks before.

Sports & Markets

Liquidity is all well and good but if an exchange doesn’t even offer the sports you enjoy betting on, it is frankly not all well and good at all. Most exchanges these days have a good selection of sports so unless your interests are rather niche this is unlikely to be too much of an issue.

However, the reason they have fewer sports covered than many bookmakers also explains why they have fewer markets in the disciplines they do offer. Betting exchanges know just how important liquidity is to their customers and indeed their entire model of betting. For this reason, they would rather channel what money people are betting into fewer markets but each with enough liquidity to be worthwhile.

To give a simple example, 500 markets on a game of football, each with £20 of money in them, will probably lead to very little getting wagered. However, 50 core markets with £200 in each are more appealing and more useful. Relatedly, and perhaps a bit of a chicken-and-egg situation, exchanges know that there is no point in them even adding some of the most unusual, niche bets, simply because there is not enough interest in them to generate the sort of liquidity that allows for a fully functioning market to form.

Checking that an exchange offers the markets you like to bet on is very important and could prove decisive in your choice of betting exchange. In some ways, this is linked to liquidity because the bigger an exchange is, and the more people it has making bets, the more money there will be in general. Often this will mean they will offer some smaller markets because they have more faith in their ability to generate liquidity for them.

Offers & Promotions

Betting exchanges do not have as many offers in general as a traditional bookmaker. Even so, this is an area that may help you pick one site over another, especially if your intention is to use the exchange only occasionally. The best way to compare exchanges in this regard is to look at their current welcome offers and the free bets and promos they have for existing customers too.

Those should be easy enough to check on the exchanges’ sites. However, if offers and bonuses are a big area of concern you may also want to try and see what they have offered in the past. This information should also be relatively easy to come by using Google (other search engines exist … apparently).

Understanding Commission

Betting exchanges do not actually take bets, instead they facilitate that process, holding the cash for the two opposing sides of a wager. For their services, they charge a commission, which typically ranges between 3% and 5%. Some exchanges may go lower, some go higher and there is also sometimes variance between different markets but 5% is a decent baseline figure to work with. This is typically charged on winning bets only.

Let’s say that you make a £10 bet at odds of 2.00 (decimal in fractional odds but exchanges invariably use decimal). Your winnings here are £10 and so 5% (for example) commission is charged on this. That equates to 50p, which is automatically deducted by the exchange.

This means that if you had £10 in your account and bet it all, your balance would be zero. Then, once the bet settled, your £10 would be returned, along with £9.50 (£10 winnings minus 50p commission). This means you would have £19.50 in your account. To calculate the commission, simply multiply the winnings by 0.05, or to calculate your returns, multiply the winnings by 0.95. Note these are based on a 5% commission rate, for 3% it would be 0.03 and 0.97.

If you, for example, wagered £126.45 at odds of 1.84, your potential winnings would be £106.22. Tidy. Assuming a 5% commission rate is applicable, we can multiply that figure by 0.95 and get £100.91. That would be the true, post-commission winnings from the bet. Alternatively, multiplying £106.22 by 0.05 shows us that you would be paying £5.31 in commission.

It should also be noted that whilst we have said that bookies tend to charge commission on winning bets only – in fact, most are more generous than that. The standard model is to charge commission on any winnings you make within a market, rather than specifically on winning bets alone.

Let’s imagine you are betting on the Grand National and decide to back each of the four favourites on the nose. You put £10 on each of them at odds between 8.2 and 12 and it is the third favourite, priced at 11 (or 10/1) that prevails. The commission on that winning bet alone is £5 (5% of £100). However, the exchange charges commission on how much you made on the market as a whole, meaning the three losing bets of £10 are factored in.

Overall, you will be £70 to the good once your three losers are taken into account. As such, you only pay commission on that £70. This means that you pay just £3.50, rather than £5. If you like to bet on the horses, golf, or other sports/markets where you may well back multiple selections, this will certainly save you a decent amount of money in the long run.

Do Exchanges Have Better Odds?

This is the age-old question and, sadly, there is no simple answer we can give. People don’t like to hear that though, so we’ll give one and it is … yes! If you were only to use one betting site ever, and your main aim was obtaining the best odds possible, then we would suggest using a betting exchange. In general, most of the time, more often than not, phrase it how you will, a top exchange would be the best option.

Now to give a longer, more complex answer. No site has the best odds all the time on all markets. It varies so much and so if your main interest is obtaining the highest prices, you simply have to shop around. So, why is the answer yes? Do exchanges have better odds? In fact, if you compare just one exchange to every single bookie, there is a decent chance that you will find a bookie with better odds, especially when you factor in the commission.

However, we suspect that if you made 100,000 bets over a range of sports and events and markets at every possible traditional bookie and every possible exchange, and then ranked the overall outcomes, the top of the table would be dominated by exchanges. For this reason, we say that overall, on average, exchanges have better prices.

There are several caveats to that though and other factors that are vital to consider, assuming that you do not intend to place 100,000 bets over a wide range of markets. First, if you only ever bet on really unusual sports and markets, the exchange may not even offer them. Even terrible odds are worse than no odds (at least in terms of getting a bet on). And, if the betting exchange does offer the market, the liquidity may be so poor that the only prices available are very poor.

Next, as mentioned, we have to account for the commission. If you see a bookie offering evens and an exchange with a price of 2.02, it is of course better to go for the “lower” odds. 2.02 after commission, even of just 3%, returns £98.94 on a £100 bet, whereas with a bookmaker and odds of 2.00, you would win £100. That said, overall, even allowing for commission, we would still argue that exchanges are generally better. But you still have to account for the commission when doing any comparison.

Perhaps one of the biggest factors to think about is what you are betting on. When exchanges first launched around 25 years ago, their odds were often much better than those of their fixed-odds rivals. Naturally, bookies responded and made their odds more competitive. However, they focussed on the areas where the most money was wagered, which means the main markets in the biggest matches of the most popular sports.

This, along with various other factors, means that there is lots of anecdotal evidence, and some fairly crude research, that shows that exchanges are particularly good when it comes to outsiders and selections at longer odds. If you like betting on dark horses in racing, the outright winner of golf tournaments, or even mainstream football bets like the first goalscorer and correct score, the chances are you will get a much bigger price at the exchange.

To offer our very own crude research into the mix, here is an ad hoc selection of bets with the odds compared. “Best bookie odds” are taken from the highest price based on a leading selection of around 20 UK bookies. All prices are shown in decimal odds format for ease of comparison.

| Selection | Best Bookie Odds | Betfair Odds |

|---|---|---|

| Enemy Coast to win 1.30 at Perth | 29 | 36 |

| Justin Rose to win the USPGA Championship | 81 | 90 |

| Brighton to beat Wolves | 1.54 | 1.55 |

| Blackpool v Millwall – 0-0 | 11 | 12 |

| Palace v West Ham to draw | 3.25 | 3.25 |

Setting Your Own Odds

One interesting thing about exchanges that very much differs from a fixed odds bookmaker is the fact that you do not have to accept the available prices. Instead, you can effectively queue for a better price. There is no security that your bet will be matched (in other words confirmed) this way, but if it does then you will have got better odds than those available when you first looked at the market.

On an exchange, you will see one price to lay a bet and another to back the same selection. However, when you are looking at the full market, to the side of these you will see shorter odds to back, to the left, and longer odds to lay, the right. Let’s say you can back Spurs at 2.74 to beat Man United or take odds of 2.76 if you want to lay them.

If you fancy Spurs but want a slightly longer price, you can increase the back odds from 2.74 to 2.78. Instead of your money being instantly matched and your bet being live, it will now sit in a queue to the right of the available lay money at 2.76. If it transpires that more people are laying Tottenham than backing them, the cash that is available at 2.76 will soon get taken and the 2.78 box, including your money, will become the price at which instant lay wagers are being matched.

If things go to plan and Spurs do drift, you will have obtained a slightly better price than had you simply accepted 2.74. However, this is not guaranteed and there is a chance that the odds might move against you, meaning you end up having to accept lower odds than the initial 2.74.

Can You Offer Any Odds?

Exchanges tend to have more limited odds than fixed-odds sites. The lowest price at most exchanges is 1.01, or 1/100, whilst the biggest price you will see is 1000, or 999/1. In contrast, bookmakers might offer 1/500, often in-play when the result is all but assured. And of course Leicester were famously priced at odds of 5,000/1 to win the Premier League in 2015/16.

However, when you are setting your own odds at an exchange, you can opt for any price within those parameters. That means that you could, in theory, opt to try and back Spurs at 1000. In reality, this would never be accepted, with unmatched bets generally cancelled once a game begins (meaning the 1000 wouldn’t even get matched if Spurs were 4-0 down with two minutes to play).

Note that you should exercise caution if you see some odds that you think might be too good to be true. Before markets fully form, some exchange users, possibly of questionable morals, may offer very silly prices, for example trying to lay Man City at 1.01 when the odds should be far higher, or trying to back a pick at odds well above the correct price. Such users are hoping to prey on people who either click a bet in error, do not fully understand the exchange, confuse backing and laying, or some similar error.

Cash Leaves Account

Note that whether you accept a price that is available for an instant match, or join the queue for better odds, the funds to cover your bet will leave your exchange account straight away. This means that if you join the queue to bet £10 on Spurs at 2.78, or any other price, £10 would be taken from your account balance to cover the bet. If it ends up not being matched it is returned to your account.

If you are trying to lay a selection, funds equal to the liability will be taken from your balance. As such, if you tried to lay Rory McIlroy at 14.50 for the Open Championship, with a stake of £20, you would actually need £270 in your exchange account to cover the wager.

Do Betting Exchanges Have Betting Limits?

The main limit you will encounter with an exchange is the liquidity in a market – well, that and your own liquidity, or funds. When it comes to a big Premier League game and the match odds, the former is unlikely to be an issue. Even a day ahead of a game you should be able to stake a high three-figure, or low four-figure sum, whilst as kick-off approaches the liquidity for an instant match may reach five or seven six figures. As alluded to elsewhere, however, on smaller markets and sports, and well ahead of the event starting, you may only be able to place much smaller bets.

However, other limits, governing maximum winnings/payouts may apply. These typically vary from exchange to exchange, sport to sport and also, within sports, the standard or level of the event. For example, the main markets in the top leagues in football might have a maximum payout of £1m. In contrast, that might drop to £100,000 for smaller competitions or markets and as low as £10,000 in others. Meanwhile, Class 1 racing in the UK and Ireland might have a £1m limit when it comes to betting on which horse will win the race, but that might drop to just £10,000 for other markets at lower levels of the sport.